- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Where's My Refund

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

JACKSON HEWITT ONLINE

Start your return

Existing Account? Sign in here

File tax returns online! File Federal & State taxes for $25 flat.

Pay one low price to file your own taxes online and get your biggest refund, guaranteed. For simple or more complex returns, you can DIY and e-file taxes conveniently from home today for only $25, we mean it.

Easy & accurate IRS online tax filing for 2024

-

Simple step by step instructions to get you started and FREE live chat support.

-

File State and Federal returns when/where you want, on desktop and mobile.

-

Download your W-2s and employer info for accuracy and speed.

-

Built-in automatic error checking for the most accurate results.

-

Pay a $25 FLAT FEE to file yourself online. Even for more complicated taxes!

STEPS TO GET YOU STARTED

Filing online is as easy as 1, 2, 3.

And you’ll only pay one low fee! No matter how complex your taxes. Seriously.

Create an account

It’s free and easy to get started with Jackson Hewitt Online. You won’t pay $25 until you file your taxes.

Gather your tax docs

Easily upload your W-2 and be ready to answer basic questions about your income, with live chat to assist.

Review & submit

After you’ve reviewed and submitted your completed tax return(s), you’ll be able to track your IRS refund, too!

WE’VE GOT YOUR BACK

What you get when you file taxes online with Jackson Hewitt

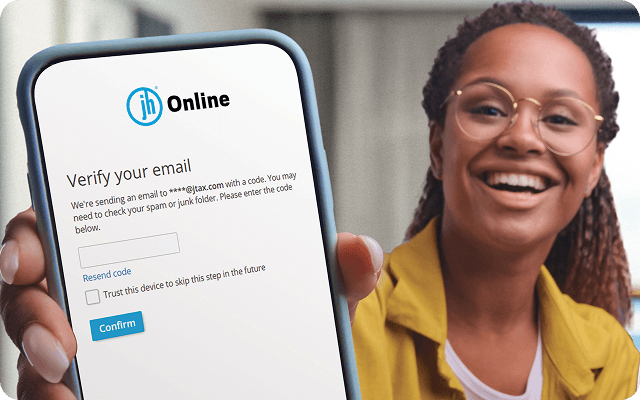

Protecting the security of your data

- Optional two-step identity verification.

- All the data you transmit is encrypted.

- Alerts every time there's account activity.

Your max refund is guaranteed

- Get a bigger refund elsewhere & we’ll reimburse your tax prep fees.

- We work hard to find every credit you're owed.

- We guarantee your biggest possible refund.

Be certain your taxes are done right

- You get our 100% Accuracy Guarantee.

- We guarantee our calculations are current & accurate.

- We pay your IRS interest & penalties if we make a mistake.

Guarantees matter!

We think you'll love Jackson Hewitt Online. But if you're not completely satisfied, we'll return your tax prep fees.

The resources you need to e-file taxes

Supported forms

Review the full list of tax forms our online filing software supports.

Tax document checklist

Get a personalized list of tax documents that you'll need when you file.

An expert Tax Pro is still here to help

If you need in-person tax support, stop by a Jackson Hewitt location near you. Our Tax Pros have the guarantees you’re looking for, like ensuring your biggest refund and our Lifetime Accuracy Guarantee®. We’ve been doing taxes for the hardest-working Americans for over 40 years. Let Jackson Hewitt help you today!

Frequently asked questions

Biggest Refund Guarantee

FEDERAL RETURNS ONLY. If you are entitled to a refund larger than we initially determined, we’ll refund the tax preparation fees paid for that filed return (other product and service fees excluded) and give you an additional $100. You must submit a valid claim and file an amended return with Jackson Hewitt by the annual IRS deadline for the year of your tax return. Same tax facts must apply. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.

Maximum Refund Guarantee

If you get a larger refund or smaller tax bill somewhere else, we'll refund your federal return fees with Jackson Hewitt Online. If you are entitled to a larger refund amount or must pay a smaller tax due amount using another tax preparation method other than Jackson Hewitt Online, then we will refund to you the applicable tax preparation fees paid by you for the Jackson Hewitt Online product/package you filed with (other product and service fees excluded). To qualify, the larger refund or smaller tax due cannot be attributed to variations in data you provided for tax preparation or for positions taken by you that are contrary to the law. Federal returns only. Same tax facts must apply. You must file an amended return with another paid tax preparation company and/or online provider by April 15, 2024 and submit your claim no later than October 15, 2024 with proof that the IRS accepted the positions taken on the amended return. This guarantee cannot be combined with the Satisfaction Guarantee.

Satisfaction Guarantee

If you are not 100% satisfied with Jackson Hewitt Online, we will refund your tax preparation fees. Printing or electronically filing your return reflects your satisfaction with Jackson Hewitt Online.

100% Accuracy Guarantee

If you have to pay interest or penalty charges to the IRS due to an error in Jackson Hewitt Online's software, we'll pay it for you.

Jackson Hewitt® warrants only to its registered users the accuracy of every form prepared using the Service. Jackson Hewitt guarantees its tax calculations as described in this Agreement. The term "Calculations" is defined to mean the numerical addition, subtraction or multiplication of numbers, and related automatic features that select numbers from tax tables. Calculations do not include any instance where a taxpayer can make a decision to substitute a number for the one automatically computed by the program, and Jackson Hewitt is not responsible for changes in tax law made by the Congress during tax season. We will pay any IRS penalties and/or interest resulting from an error in Jackson Hewitt's Online software program's calculations. You are responsible for notifying Jackson Hewitt promptly of any change in your email so that notices of necessary updates or corrections to remedy any errors can be provided by Jackson Hewitt. You are responsible to notify Jackson Hewitt within 10 days of receipt of any notice of errors and/or interests and penalties from any tax authority resulting from your use of the Service. If the tax return can be amended to avoid or reduce your penalties and/or interests, you must file it on your own to limit further penalties and interest. We are not responsible for any interests and penalties resulting from your failure to enter all required information accurately, your willful or fraudulent omission or inclusion of information on your tax return, your misclassification of information on your tax return, your failure to notify Jackson Hewitt of your change of email address, or your failure to file an amended return to avoid or reduce your penalties and/or interests after receipt of such notice. If you believe such a calculation error occurred and you have complied with the above conditions, please notify Jackson Hewitt in writing at Jackson Hewitt Inc., Attention - Client Care, 501 N. Cattlemen Road, Suite 300, Sarasota, FL 34232 as soon as you are aware of the error. You must include a copy of the IRS notice, a hard copy of the tax return, and your online username. The filing of such a claim shall constitute your authorization for Jackson Hewitt to obtain and review any copy and/or transcript of your tax return and any data files that may be in Jackson Hewitt's possession or control in order to evaluate your claim. You are responsible for paying any additional tax liability you may owe, and providing assistance and additional information as reasonably requested by Jackson Hewitt.

Lifetime Accuracy Guarantee

If there is an error preparing your return resulting in an increased tax liability, the local office that prepared your return will reimburse you for penalties and interest (but not additional taxes) owed. You must notify us within 30 days of receiving initial notice from a taxing authority and provide necessary documents and/or assistance. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.

Jackson Hewitt Online Transparent Pricing Guarantee

You’ll pay tax prep fees of no more than $25 when you file with Jackson Hewitt Online, or we’ll refund your tax preparation fees.

Regardless of the complexity of your tax return or the number of states in which you must file, you are guaranteed to pay no more than $25 total tax prep fees ($25 federal, $0 states) when you file your own taxes with Jackson Hewitt Online or your tax prep fees back. Guarantee applies only to tax prep fees and does not include additional add-on services such as eCollect or Protection Plus fees.

Typical coverage during tax season (Jan - Apr):

9AM – 11PM ET Mon-Fri

9AM – 6 PM ET Saturday

If outside of business hours, chats are typically answered in the morning.

Outside of tax season

8AM – 5PM ET Mon-Fri

Biggest Refund Guarantee

FEDERAL RETURNS ONLY. If you are entitled to a refund larger than we initially determined, we’ll refund the tax preparation fees paid for that filed return (other product and service fees excluded) and give you an additional $100. You must submit a valid claim and file an amended return with Jackson Hewitt by the annual IRS deadline for the year of your tax return. Same tax facts must apply. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.